Accounting For Software Development Costs For Internal Use

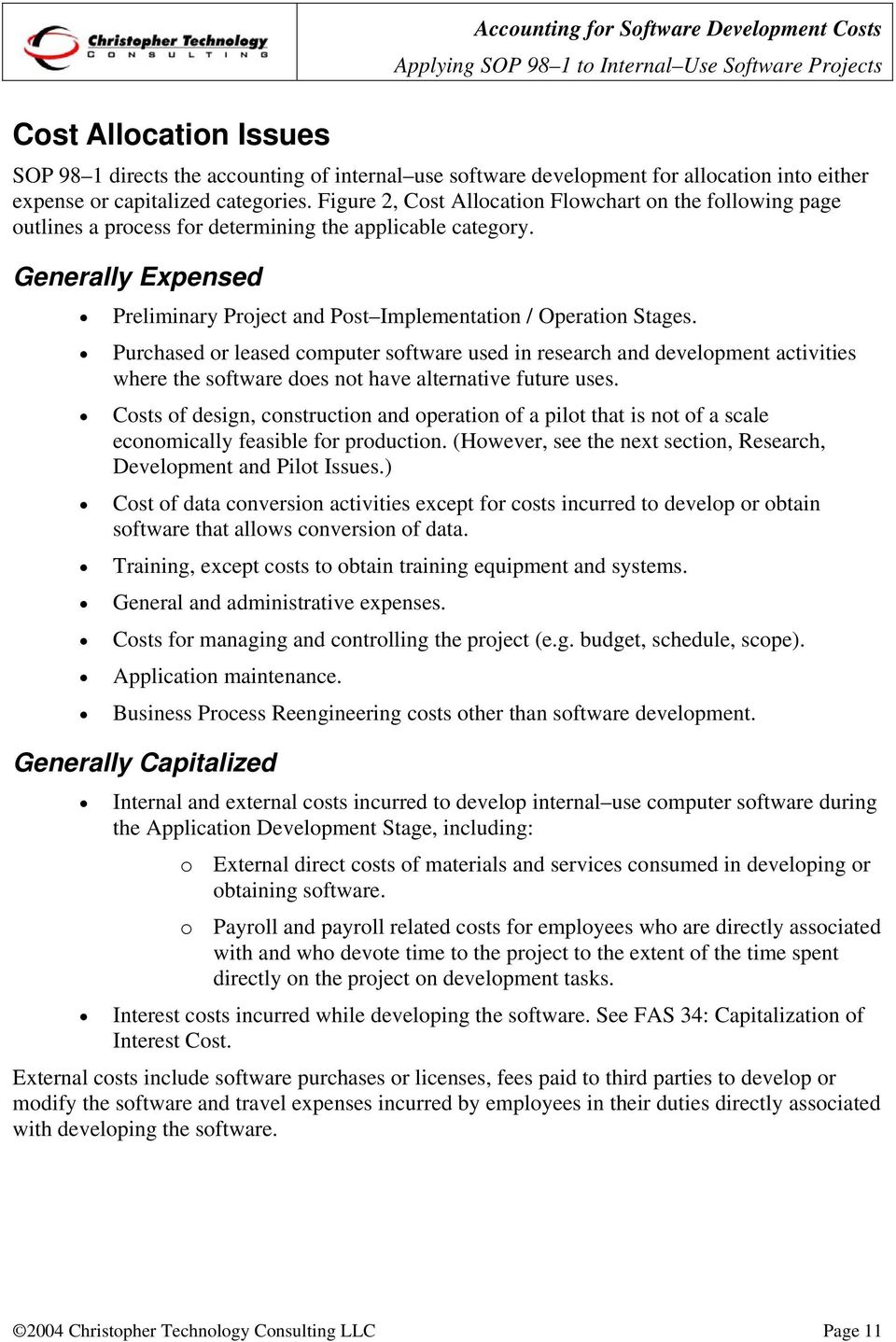

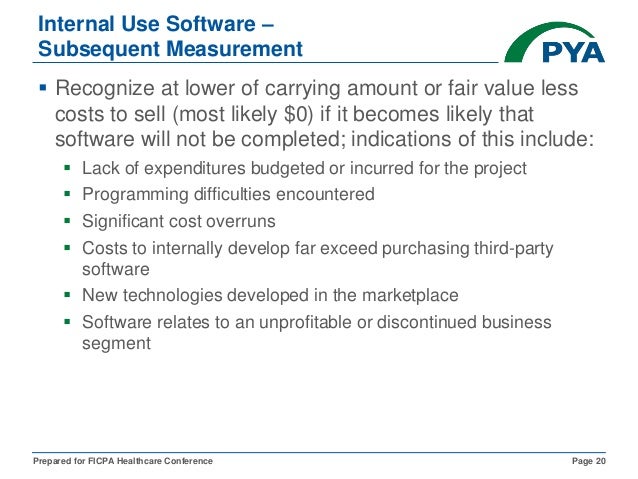

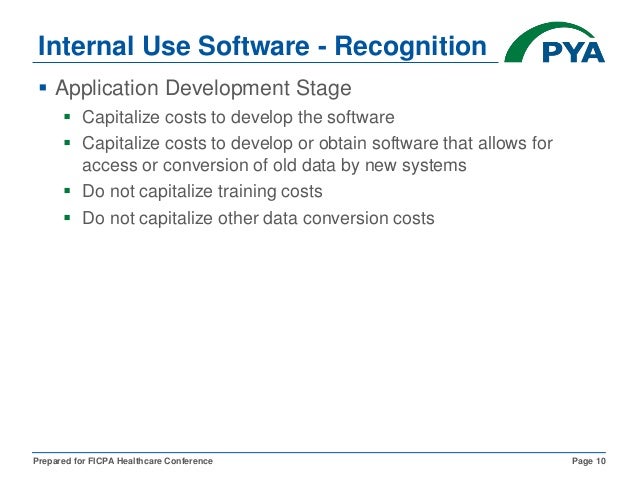

Once the software is put into service all capitalized costs related to internal use software are amortized over the estimated useful life of the software which is typically 3 5 years. All costs incurred during the preliminary stage of a development project should be charged to expense as incurred.

Accounting For External Use Software Development Costs In An

Accounting For External Use Software Development Costs In An

accounting for software development costs for internal use is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark accounting for software development costs for internal use using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

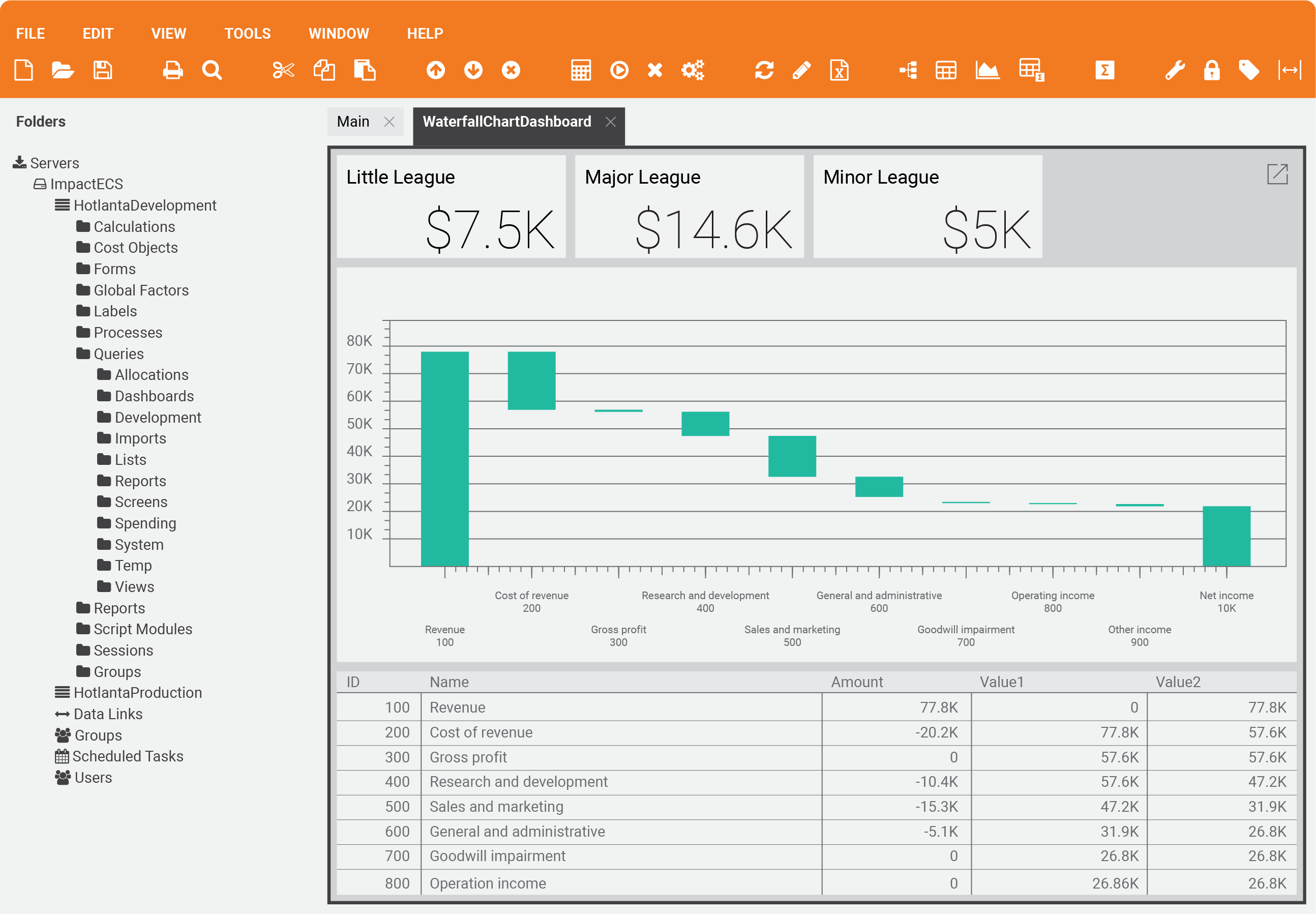

Capitalization of internal use software costs is an area where companies often misapply gaap codification topic 350 40.

Accounting for software development costs for internal use. The accounting guidance specifies 3 stages of internal use software development and during which stages capitalization is required. One possible single model solution is the ifrs model for accounting for research and development costs. Uncertainty created among internal accounting brethren on how to capitalize costs in an agile environment.

The relevant accounting is. Aligning development costs associated with internal use software software for sale and other technologies into a single accounting model could be a significant simplification. The accounting for internal use software varies depending upon the stage of completion of the project.

Accounting for internal use software under asc350 40 was originally predicated on waterfall methodologies so what happens when implementing these new software development processes. How do you manage that. The threshold for software development costs for external sale or licensing the focus of this article is more stringent which means more analysis is required to determine which development costs should.

Software capitalization accounting rules. Under the internal use software rules development costs generally can be capitalized after the end of the preliminary project stage.

Accounting For Capitalized Software Costs Wall Street Prep

Accounting For Capitalized Software Costs Wall Street Prep

Accounting For External Use Software Development Costs In An

Accounting For External Use Software Development Costs In An

Accounting For Capitalized Software Costs Wall Street Prep

Accounting For Capitalized Software Costs Wall Street Prep

Accounting For Software Development Costs Pdf

Accounting For Software Development Costs Pdf

Sop Accounting For The Costs Of Computer Software Developed

Sop Accounting For The Costs Of Computer Software Developed

Accounting For Software Implementation And Physician Guarantees

Accounting For Software Implementation And Physician Guarantees

Accounting For Software Development Costs Pdf

Accounting For Software Development Costs Pdf

Accounting For Your Institution S Core Software Conversion

Accounting For Your Institution S Core Software Conversion

Sop 98 1 Accounting For The Costs Of Computer Software

Sop 98 1 Accounting For The Costs Of Computer Software

Capex And Opex Scaled Agile Framework

Capex And Opex Scaled Agile Framework

Accounting For Software Implementation And Physician Guarantees

Accounting For Software Implementation And Physician Guarantees